Replacement Cost vs. Actual Cash Value: A Homeowners Insurance Guide to Protect Your Roof

February 13, 2025

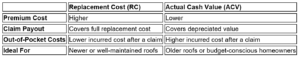

When it comes to protecting your home, your homeowners insurance policy plays a critical role. One key decision you’ll need to make is whether to insure your roof—and possibly other parts of your home—using replacement cost (RC) or actual cash value (ACV) coverage. Understanding the differences between these two settlement types can help you make the right choice for your needs and budget.

What Is Replacement Cost Coverage?

Replacement cost coverage pays the full cost of replacing your damaged property with a new equivalent, without factoring in depreciation. Think of it like trading in a worn-out sofa for a brand-new one of the same quality at today’s prices—the insurer covers the cost to replace the old sofa with the new, regardless of the its age or condition. For a roofing example:

- If your roof is destroyed in a covered storm and a comparable roof’s replacement cost is $15,000, your insurer will reimburse you $15,000 (minus your deductible), regardless of the roof’s age or wear.

- Replacement cost policies typically require higher premiums, but they can save you significant out-of-pocket expenses if your property is damaged or destroyed.

What Is Actual Cash Value Coverage?

Actual cash value coverage reimburses you for the depreciated value of your property at the time of loss. Depreciation reflects factors such as the item’s age, wear and tear, and reduced usefulness, which are deducted from the original value to calculate its current worth. This means:

- Your payout reflects the item’s age, condition, and remaining useful life.

- Using the same roof example, if the roof initially cost $15,000 but has depreciated by $5,000, the insurer would reimburse you $10,000 (minus your deductible).

- While ACV coverage usually comes with lower premiums, it may leave you with higher out-of-pocket costs after a claim.

Examples: How These Coverage Types Work

Let’s compare two scenarios to illustrate the differences:

- The Robertsons’ Roof (Replacement Cost Policy): Their 10-year-old roof sustains $15,000 worth of storm damage. The Robertsons’ replacement cost policy reimburses them $14,000 ($15,000 repair cost minus their $1,000 deductible).

- The Ryans’ Roof (Actual Cash Value Policy): The Ryans’ 10-year-old roof, with $15,000 worth of storm damage, has depreciated by $5,000. Their ACV policy reimburses them $9,000 ($15,000 replacement cost minus $5,000 depreciation and a $1,000 deductible).

Pros and Cons of Replacement Cost vs. Actual Cash Value

Factors to Consider When Weighing Your Risk

- Roof Age and Condition: Insurers may limit replacement cost coverage for older roofs, particularly those showing signs of wear, such as curling, missing shingles, or visible leaks. Regular maintenance, such as clearing debris and inspecting for damage, can improve your eligibility for better coverage options.

- Premium Budget: If you’re looking for lower monthly costs, ACV might be a better option.

- Your Home’s Risk Profile: For homes in high-risk areas, replacement cost coverage could be a more reliable option.

- Potential Costs After a Loss: Consider how much you’d need to pay out of pocket if your roof were damaged.

Steps to Make the Right Choice for You

- Review Your Policy: Examine details like policy limits, exclusions, deductibles, and any specific provisions that might affect your roof coverage. Pay close attention to whether your roof is covered under replacement cost (RC) or actual cash value (ACV). Confirm whether your current roof coverage is RC or ACV.

- Evaluate Rebuilding Costs: Calculate the full replacement cost of your home, including roofing materials and labor.

- Consult Your Robertson Ryan Insurance Agent: Discuss the specifics of your roof’s condition, local building codes, and available policy options.

Additional Tips

Upgrading Your Roof: Installing durable, impact-resistant materials, may reduce your premiums. Here is more information on roofing material types. Check with your insurer to confirm which materials qualify for premium reductions.

By understanding the difference between RC and ACV coverage, you can make informed decisions to safeguard your home and finances. For personalized guidance, contact your Robertson Ryan Insurance Agent today.