Weather as it Relates to Increasing Property Insurance Premiums

February 28, 2024

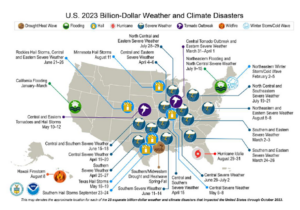

Weather patterns and their impact on insurance premiums are intricately linked. Below is a breakdown of various types of weather and climate events that affect the United Sates as a whole when it comes to weather related insurance claims.

Severe weather/convective storms — 2023 saw 19 severe weather/convective storm events, including tornado outbreaks, heavy wind and rainfall, thunderstorms and hailstorms. Such storms cost an average of $2.4 billion per event.

Floods—There were four large-scale flooding events in 2023. On average, these disasters cost $4.5 billion per event.

Tropical cyclones—The country was affected by two tropical cyclones (e.g., hurricanes, monsoons and typhoons) last year. Such disasters often leave behind the most severe damage, costing an average of $22.2 billion per event.

Winter storms/cold waves—One winter storm/cold wave event took place this past year. On average, these disasters cost $4.5 billion per event.

Wildfires—There was one major wildfire event in 2023. Such disasters cost an average of $6.5 billion per event.

Droughts/heat waves—One drought/heat wave event occurred last year. On average, these disasters cost $11.4 billion per event.

Changes in weather can significantly impact insurance premiums due to their direct correlation with risk and the likelihood of claims. Here’s how different weather patterns can influence insurance premium increases:

- Severe Weather Events: Extreme weather events such as hurricanes, tornadoes, hailstorms, and floods can cause substantial damage to properties and infrastructure. Insurance companies anticipate higher claims payouts in regions prone to these events. Consequently, they adjust premiums to cover the increased risk of property damage and loss.

- Frequency and Severity of Natural Disasters: Climate change can lead to an increase in the frequency and severity of natural disasters. As a result, insurers may raise premiums to compensate for the elevated risk of claims associated with these events. For example, if an area experiences more frequent and intense wildfires or hurricanes, insurers may adjust premiums to reflect the heightened risk of property damage and loss.

- Property Location and Vulnerability: Properties located in areas prone to specific weather-related risks, such as coastal regions susceptible to storm surges or regions prone to wildfires, may face higher insurance premiums. Insurers consider the vulnerability of properties to weather-related hazards when determining premiums, reflecting the increased likelihood of claims in high-risk areas.

- Loss Experience and Claims Data: Insurance companies analyze historical loss experience and claims data to assess the impact of weather-related events on their portfolios. If there is a trend of increasing claims frequency or severity due to weather-related factors, insurers may adjust premiums to account for the elevated risk of future losses.

- Reinsurance Costs: Insurers often purchase reinsurance to mitigate their exposure to catastrophic losses resulting from weather-related events. If reinsurers increase their rates due to heightened weather-related risks, primary insurers may pass on these higher costs to policyholders through premium increases.

- Regulatory Requirements: Regulatory changes aimed at addressing climate-related risks can influence insurance premiums. Government regulations may require insurers to adjust their underwriting practices or offer coverage for specific weather-related perils, potentially affecting premium rates.

- Technological Advances and Risk Assessment: Advancements in technology, such as improved weather forecasting and risk modeling techniques, enable insurers to better assess and quantify weather-related risks. As insurers gain a more nuanced understanding of these risks, they may adjust premiums to reflect the latest insights and data.

Changes in weather patterns can lead to insurance premium increases by impacting the frequency and severity of claims, increasing property vulnerability, affecting reinsurance costs, and influencing regulatory requirements and risk assessment methodologies. Insurers adjust premiums to align with the evolving risk landscape and ensure their financial stability in the face of weather-related challenges.

Reach out to your Robertson Ryan trusted insurance advisor with any questions about your coverage or to get a new quote. Contact Us